It is now more likely that adjustments in commercial real estate could tighten credit conditions for UK businesses. Foreign flows of capital into commercial real estate fell 50% in the first quarter of 2016, transaction volumes have fallen further during the second quarter, and share prices of property REITs dropped sharply following the referendum.

In addition, the number of vulnerable households could increase due to a tougher economic outlook and a potential tightening of credit conditions. In particular, there is growing evidence that uncertainty about the referendum has delayed major economic decisions, such as business investment, construction and housing market activity

3-Year Chart of the UK ETF

Benchmark 10-year note yields slid together with those on 30-year securities as signs of slowing growth in Europe ended a five-day gain in global stocks. In the U.S., a jobs report Friday may will offer clues as to the direction of the Federal Reserve’s next interest-rate move. The odds in futures markets of tighter U.S. policy this year fell after the U.K. unexpectedly voted last month to leave the European Union, clouding the outlook for global growth. Treasuries were closed globally July 4 for the U.S. Independence Day holiday.

5-Year Chart of the 30-2 Spread

5-year Chart of the 10-2 Spread

5-Year Chart of the Dollar

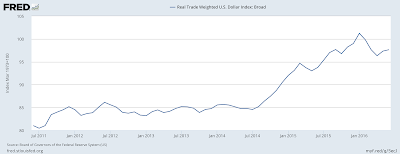

5-Year Chart of the Trade Weighted Dollar

This time it’s not Britain’s David Cameron but Italy’s Matteo Renzi, who has called a vote on an ambitious overhaul of the political system aimed at ending the country’s unstable governments. If he loses, Renzi has promised to quit, an outcome that Citigroup Inc. called probably the biggest risk in European politics this year outside the U.K.

The vote is expected in October, though it is already spooking investors and Italian bonds are once more under-performing their Spanish peers. The yield on 10-year Italian securities overtook those on similar-maturity Spanish debt for the first time in almost a year on June 27, a day after Spain’s Acting Prime Minister Mariano Rajoy defied opinion polls to consolidate his position in a general election.

1-Year Chart of the Italy ETF

3-Year Chart of the Italy ETF

At its meeting today, the Board decided to leave the cash rate unchanged at 1.75 per cent.

The global economy is continuing to grow, at a lower than average pace. Several advanced economies have recorded improved conditions over the past year, but conditions have become more difficult for a number of emerging market economies. China's growth rate has moderated further, though recent actions by Chinese policymakers are supporting the near-term outlook.

Commodity prices are above recent lows, but this follows very substantial declines over the past couple of years. Australia's terms of trade remain much lower than they had been in recent years.

Financial markets have been volatile recently as investors have re-priced assets after the UK referendum. But most markets have continued to function effectively. Funding costs for high-quality borrowers remain low and, globally, monetary policy remains remarkably accommodative. Any effects of the referendum outcome on global economic activity remain to be seen and, outside the effects on the UK economy itself, may be hard to discern.

In Australia, recent data suggest overall growth is continuing, despite a very large decline in business investment. Other areas of domestic demand, as well as exports, have been expanding at a pace at or above trend. Labour market indicators have been more mixed of late, but are consistent with a modest pace of expansion in employment in the near term.

Inflation has been quite low. Given very subdued growth in labour costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time.

5-Year Chart of the Australian Dollar and Yuan

3-Year Chart of the Australian ETF