Saturday, November 8, 2014

Weekly Indicators for November 3 - 7 at XE.com

- by New Deal democrat

My Weekly Indicator post is up at XE.com.

Global weakness is affecting US data at the margins.

Friday, November 7, 2014

Four important graphs about jobs for October 2014

- by New Deal democrat

As you know, since the expansion in jobs is firmly in place, recently I have turned my attention to metrics of underemployment and wages.

We're having the best year for jobs added in over a decade. Jobs have grown by almost 2% in the last 12 months. This is about 1% over population growth and should get us to full employment in about two years, if the trend continues.

Let's look at a few measures of labor underutilization beyond the unemployment rate.

First, here is the employment to population ratio for ages 25-54, Prof. Krugman's favorite shorthand measure:

This made a new post-recession high in the latest report. It is 2.1% off its bottom and is 2.9% off 79.5%, a reasonable figure for full employment.

Next, here is involuntary part time employment as a share of the civilian labor force:

This is about 1.5% higher than during full employment years. Note it is also following a trajectory similar to that following the severe 1982 recession.

Next, here is the number of those who aren't even counted in the civilian labor force but want a job now:

This one is bad news. It has been moving in the wrong direction ever since Congress cut off extended unemployment benefits at the end of last year, and is back close to 2 million above where it should be for full employment.

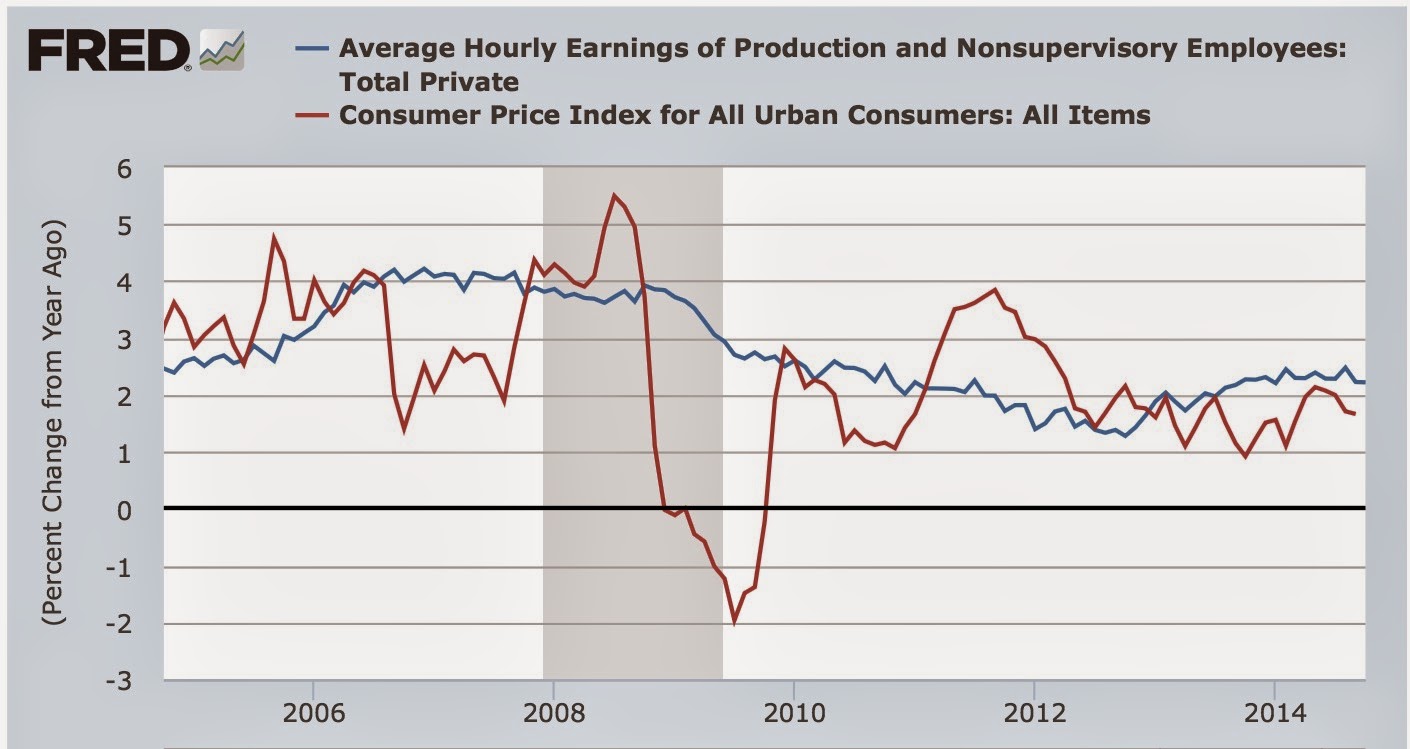

Finally, here is a look at wage growth for nonsupervisory personnel (blue) vs. consumer inflation (red):

This is a little bit concerning, because nominal wage growth, now +2.2% YoY, has gone in the wrong direction in the last couple of months. On the other hand, real wages have grown, because consumer inflation has declined (thank you, gasoline!). I do expect both the nominal and inflation adjusted numbers to improve in the coming months. We'll see. The bottom line for now is, real wages have improved slightly, but over the longer term remain stagnant.

October jobs report: solid improvement, except for discouraged workers

- by New Deal democrat

HEADLINES:

- 214,000 jobs added to the economy

- U3 unemployment rate fell from 5.9% to 5.8%

Wages and participation rates

- Not in Labor Force, but Want a Job Now: rose 188,000 from 6.349 million to 6.537 million

- Employment/population ratio ages 25-54: up 0.2% from 76.7% to 76.9%

- Average Weekly Earnings for Production and Nonsupervisory Personnel: up $.04 to $20.70 up 2.2% YoY

Since the economic expansion is well established, in recent months my focus has shifted to wages and the chronic heightened unemployment. The headline numbers for October continue to show a little progress on wages, and mixed results on participation.

Those who want a job now, but weren't even counted in the workforce were 4.3 million at the height of the tech boom, and were at 7.0 million a couple of years ago. Since Congress cut off extended unemployment benefits at the end of last year, they have actually risen by over half a million, and this month were 6.537 million.

On the other hand, the participation rate in the prime working age group has made up over 40% of its loss from its pre-recession high.

After inflation, real hourly wages for nonsupervisory employees probably rose from September to Ocotbe. The nominal YoY% change in average hourly earnings is 2.2% somewhat better than the inflation rate.

The more leading numbers in the report tell us about where the economy is likely to be a few months from now. These were flat to slightly positive

- the average manufacturing workweek was unchanged at 40.8 hous. This is one of the 10 components of the LEI.

- construction jobs increased by 12,000. YoY construction jobs are up 464,000.

- manufacturing jobs were up 15,000, and are up 170,000 YoY.

- Professional and business employment rose 37,000 and is averaging a 56,000 monthly gain for the last year.

- temporary jobs - a leading indicator for jobs overall - increased by 15,100.

- the number of people unemployed for 5 weeks or less - a better leading indicator than initial jobless claims - increased by 90,000 from 2,383,000 to 2,473,000, compared with last December's 2,255,000 low.

Other important coincident indicators help us paint a more complete picture of the present:

- Overtime hours were down from 3.5 hours to 3.4 hours.

- the index of aggregate hours worked in the economy rose sharply by 0.5 to 101.9

- The broad U-6 unemployment rate, that includes discouraged workers decreased from 11.8% to 11.5%

- Part time jobs for economic reasons decreased by -76,000 to a total of 7.027 million.

- the alternate jobs number contained in the more volatile household survey increased by 683,000 jobs. This is a 3,8 million increase in jobs YoY vs. 2,643,000 in the establishment survey.

- Government jobs increased by 5,000.

- the overall employment to population ratio for all ages 16 and above rose 0.2% from 59.0% to 59.2%, and has risen by +1.0% YoY. The labor force participation rate rose from 62.7% to 62.8%, and is unchanged YoY - an actual improvement! (and remember, this includes droves of retiring Boomers).

Of the important metrics I am watching now, adjusted for inflation, nonsupervisory wages probably also rose this month, albeit slightly.

Additionally, higher paying construction, manufacturing, and business and professional service jobs are showing consistent improvement. In other words, with continued improvement in overall employment, it looks like the manta that the economy is only adding low paying jobs is beginning to give way.

The one big sore spot is the continuing increase in people who have completely stopped looking, but want a job now. On the other hand, the employment to population ratio among the prime 25-54 working age group made a new post-recession high, and is over 40% back to pre-recession levels - not great, but improvement nevertheless.

Thursday, November 6, 2014

Hmmmm... I see a pattern here

- by New Deal democrat

[Note: regular economic blogging will resume with the Jobs Report tomorrow morning]

Gloria Borger, CNN:

David Atkins, Digby's blogNow voters demand change elections more often than they don't. Consider this: Republicans win the Senate in 2002, then lose it in 2006. The Democrats hold the Senate until losing control of it last night -- predictions are that they might be in a good position to take it back in two years.At some point, someone might start listening: Voters are steaming. They're anxious.... .... [W]hat happened last night is not a communications problem. It's a governing problem. Almost 8 out of 10 voters who voted yesterday don't trust the government to do the right thing

[T]his was yet another wave election. The latest in a long string since 2006. It needs to be said again.

Turnout keeps declining in midterm elections as people lose faith in the political process. And the people who do vote, consistently vote for someone to change something. It's entirely likely that people will be fed up with Republicans fighting one another and putting terrible bills on the President's desk and vote again for change in the other direction in 2016--particularly with a larger, more progressive electorate. Not a given, of course, but likely.

And why not? The country is broken, and everyone who isn't already wealthy knows it. .... And it seems like absolutely nothing is going to change any of that, no matter who gets into office....

Eventually this will reach a breaking point. It has to. It'll break when some sufficiently large crisis occurs, and one side is fully prepared to use that seething rage for constructive outcomes.

The party that is more ready for that moment will be the one that makes real policy changes. Until then, we'll just keep surfing waves ....Markos Moulitsas:

In 2004, Republicans won big, and Democrats were left trying to figure out what went wrong.Let me distill this down to its essence. In a legacy two party system from which there appears to be no escape, voters have no choice but to throw the current crop of bums out, and give the other crop of bums another chance, until one or other of the groups of bums actually starts addressing their problems.

Then in 2006, Democrats won big, and they decided everything was fine. Republicans merely shrugged it off as the 6-year-itch that bedevils parties that hold the White House in a president's last midterm.2008, Democrats won big again, and Republicans were left fumbling for excuses, but mainly decided it was Bush's fault and an artifact of Barack Obama's historic campaign.In 2010, Republicans won big, so they were validated. All was fine! Democrats were left fumbling.In 2012, Democrats won big, so they decided everything was fine. Demographics and data to the rescue! Republicans decided to rebrand, until they decided fuck that, no rebranding was needed.And now in 2014, Republicans are validated again in the Democrats' own 6-year-itch election. Democrats are scrambling for answers.And I'll tell you what the future looks like:In 2016, Democrats will win big ....In 2018, Republicans will win ....Then in 2020, Democrats will win ........ And that cycle won't be broken until 1) the Democrats figure out how to inspire their voters to the polls on off years, or 2) Republicans figure out how to appeal to the nation's changing electorate.

Unit labor costs flat

- by New Deal democrat

This morning the BLS reported Unit Labor Costs. This measures how productive labor is, by measuring it per unit of production. The index rose slightly in the 3d Quarter, but 2nd Quarter ULC were revised downward, making the index essentially flat this year:

Note that over the last few years, however, unit labor costs have risen slowly (which is good for labor). This is also shown when we measure ULC by their YoY% growth:

(ignore the upward and downward spikes from 4Q 2012 and 2013, which were due to tax strategies by corporations in anticipation of the ending of the Bush tax cuts).

Finally, corporate profits deflated by unit labor costs is a long leading indicator. Here it is measured YoY for the last 65 years:

A negative number doesn't guarantee a recession in the next year or so, but it does most of the time, and further, there has almost never been a recession without being preceded by a negative number.

Finally, let's zoom in on the last 10 years (note this only goes through Q2, but corporate profits have generally been positive, so we should see another positive number when this is reported next month).

This shows ULC growing slightly less than profits for the last several years. While I'd like to see better improvement in labor's position, this does suggest strongly that 2015 will be another positive year for jobs.

Average weekly earnings and the Employment Cost Index have also risen off their post-recession bottoms. Tomorrow in the jobs report we will get our first read on how that is carrying over into the 4th Quarter.

Wednesday, November 5, 2014

A disengaged oil choke collar + rising wage growth is almost pure good news

- by New Deal democrat

I have a new post up at XE.com. Falling commodity (gas) prices plus rising wages has been a sure sign of continued growth, going back 50 years.

A little post-election-day economic balm

- by New Deal democrat

Perchance you would like to ponder something other than politics this morning. In that case, let me offer you some economic balm.

The likelihood is that absolutely nothing is going to get done in Washington in the next two years. In fact, I expect - and hope - that exactly one thing happens, and that is that the US does not default on its debts via a Debt Ceiling Debacle even worse than the one we had in 2011. (and please, pretty please, Obama, resist the urge to cave in to a "grand bargain" on your way out the door).

If Washington can simply manage to do absolutely nothing to the economy in the next two years, except to agree to pay already incurred debts (a/k/a lift the debt ceiling), then we are in the best position we have been in for nearly a decade for the economy by itself to improve the lot of the working and middle class appreciably.

Here's why:

- there is nothing in the long leading indicators to suggest that we are going to enter an economic downturn at any point in at least the next 9 months. If interest rates continue to drift lower and housing starts improve as a result, you can extend that forecast into 2016.

- continuing economic growth means continuing positive monthly jobs reports

- so long as there is positive jobs growth, and initial jobless claims stay at or near their current levels, the unemployment rate is going to continue to decline -- and that's not just the usual rate, but all the other variations on the unemployment rate as well.

- Because the unemployment rate should remain below 6.5% for the foreseeable future, that means that nominal wage growth, which has been improving for the last 18 months, will continue to improve further - i.e., to 2.5% YoY or 3.0% YoY.

- Also, incremental tightness in the labor market is going to mean that better paying jobs become an increasing share of employment - my hypothesis is that this recovery is no different from previous recoveries, where low wage jobs get added first, and higher wage jobs get added later. Like the expansion after the deep 1982 recession, there was so much slack that it took a long time for those higher paying jobs to show up. There is evidence from the last few jobs reports that it is beginning to happen.

- Unless there is a reversal in gas prices, this is going to mean significant real wage growth to the average working family.

In short, simply leaving the economy alone for the next 2 years is likely to mean a continued improvement in the jobs picture, and a significant improvement on the wage front. Or, if ever there was a time when laissez faire might be a perfectly decent policy, this point in the cycle is it.

Just the probabilities, I know. Lots could go wrong. But the above scenario isn't just plausible, among the plausible scenarios, it is the most likely.

Monday, November 3, 2014

Initial jobless claims forecast 280,000 +/-80,000 jobs created in October UPDATED

- by New Deal democrat

The level of initial jobless claims has been doing a good job in this expansion of forecasting the general level and direction of both employment and the unemployment rate. While I haven't been able to do a formal regression analysis, the below scatter graph, showing the level of initial jobless claims on the bottom axis, and the monthly change in employment on the left axis, shows that for every 10,000 monthly average decline in jobless claims, there has been an increase of 10,000 to 12,000 jobs in the monthly jobs report:

Keeping in mind that in October we had the lowest initial jobless claims reports since 2000, the midpoint of the distribution for the October jobs number is about 280,000. With the exception of a few outliers, jobs reports have typically come within 80,000 of that midpoint, giving us a range of 200,000 at the low end and 360,000 at the high end.

Also, since initial claims tends to lead the trend in the unemployment rate by several months, I am expecting a further decline in that rate from 5.9% within the next two months.

And since the unemployment rate has been a good leading indicator for nominal wage growth, I am also expected nominal wages for nonsupervisory employees to improve from their present 2.2% YoY in the next several months as well.

========================

UPDATE Wed. Nov. 5

Many thanks to Craig Eyermann at Political Calculations, who via Doug Short ran the regression on the above data. Here's theactual mathematical regression:

Eyermann cautioned: "On the whole, I would describe the overall correlation as fairly weak - I wouldn't use the regression to attempt to predict either value."

Erm, uh, well, since I already did that, I guess we'll just sit back and see what happens on Friday! FWIW, the regression does suggest a result centered on 261,000.

Sunday, November 2, 2014

Consumers' (accurate) bifurcated take on the economy - and why that isn't good for Democrats

- by New Deal democrat

Naked Capitalism picked up a piece from Wolf Richter the other day (subsequently copied-and-pasted by the Pied Piper of Doom) entitled, The shrinking piece of a barely growing economy: why the Glorious Economy of ours feels so crummy. It's ultimate conclusion is,

Since PCE is used to adjust GDP for inflation, “real” economic growth has been systematically overstated by understating inflation. If GDP had been deflated over the years with CPI, instead of PCE, that measly 2.3% growth of per-capita GDP since 2007, as crummy as it may appear, would likely benegative. And that explains why so many people – struggling with soaring rents, medical expenses, college costs, etc. – find that their slice of the economic pie has been shrinking since the financial crisis.

Is the economy actually "shrinking?" Do consumers really think it's "crummy?" Although the facts do not support either of these assertions, as we will see the benefits have skewed towards those whose incomes normally are associated with GOP voters.

The first clue that this is a cherry-picking Doomer piece is the use of the present progressive tense, to convey the sense of an ongoing trend, and the selection of a specific starting point. Now, there are good reasons not to use GPI as the GDP deflater, since GDP measures a lot more than consumer activity, even though it is the largest component, but let's pass that. Richter's claim that if GDP were deflated by CPI, "would likely be negative" since 2007, is easy to examine. It took be about 3 minutes to generate the graph at the St. Louis FRED. And technically, if we simply compare Q3 2014 to Q3 2007 in that graph, indeed Q3 is 0.3% lower than the 2007 peak.

Which make me wonder why he didn't do it. Probably because when you graph real per capita GDP deflated by PCE (red) and compare it with real per capita GDP deflated by CPI (blue), and put it in the context of a longer term (here, 20 years), this is what you get:

Does this look like an economy that is "shrinking" to you? Whichever way we measure, the economy per capita shrank (past tense) by 5% or 6% in 2008 and 2009, and has grown by about 6% to 7% since then, over 5 years. Since 2010, with the exception of 3 quarters in 2011, real per capita GDP has grown at a similar rate regardless of whether DPI or PCE is used as the deflator:

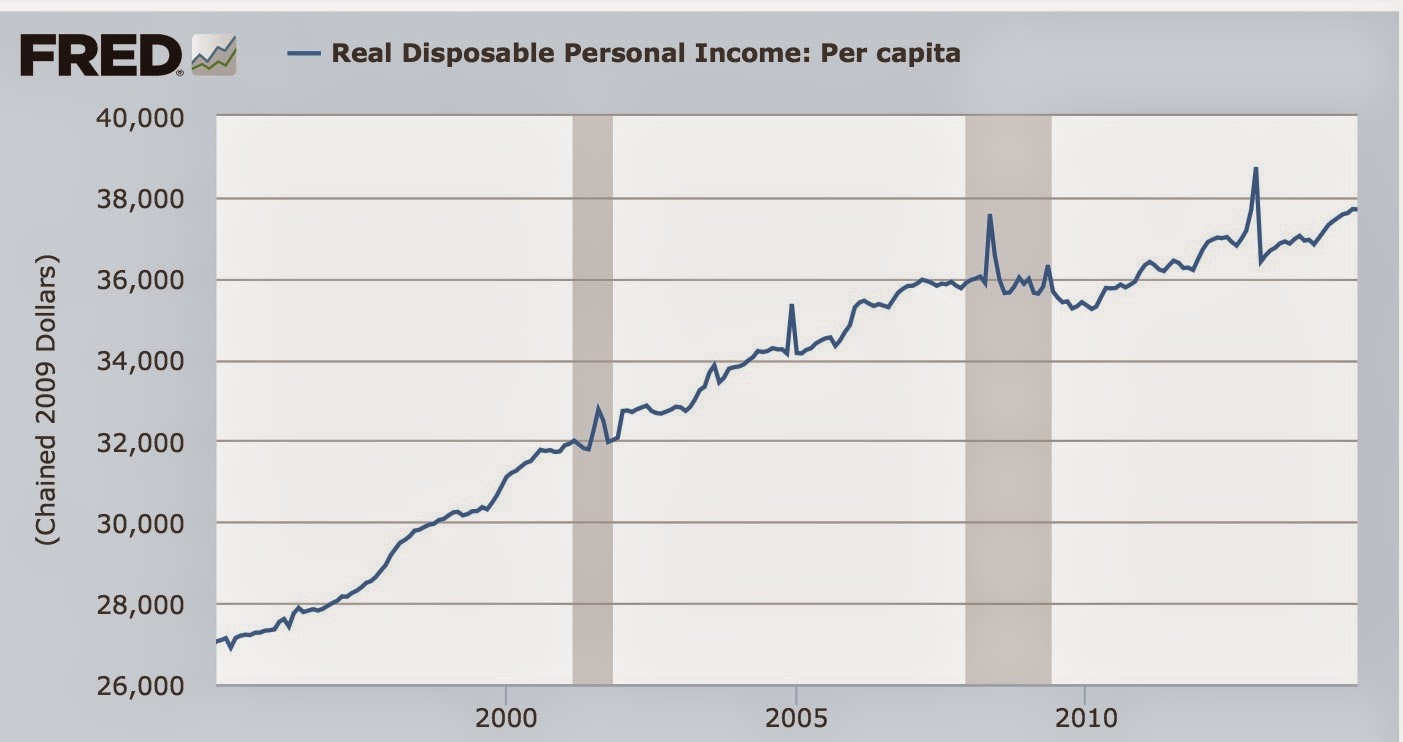

Not only that, but real per capita disposable income has made a new high as well:

So, if I were happy with GDP in 2007, why wouldn't I also be happy now, if on a per capita basis, it is less than 0.3% from the peak quarter of that year?

Assuming that is true, then the answer, presumably, is that the benefits of the expanding economy for the last 5 years have by no means been evenly shared, something Richter mentions in only one sentence, with no data in support.

This is also easy to examine. Here's a graph of the labor share of GDP. This has sunk like a stone since the turn of the Millennium, before stabilizing at a very low level in the last 4 years:

Now let's deflate real GDP per capita by this labor share, and see how the average worker is experiencing GDP:

Since the labor share has not significantly improved after plummeting in the recession, the average worker, unlike GDP as a whole, has not returned to their level of financial well-being in 2007 - although even for them the situation has improved significantly since the bottom.

Here's an alternate way of looking at the same thing. This is average hourly wages, deflated by the CPI, and deflated further by the unemployment rate. This gives us a good measure of the average income received those who are working plus those who want to work, but haven't found a job:

Note that after flatlining pretty much since the Millennium, it has turned up in the last 18 months or so.

And that's what consumers are telling the pollsters. Here's the Conference Board's consumer confidence measure:

And here's the similar measure by the Univesity of Michigan:

Note that the present conditions index for each, while not all the way back, is close to where it was in the last expansion. And here's a look at Gallup's economic confidence index as well, first over the longer term:

And now for the last year:

Note the improvement here as well.

And remember this graph, when Pew Research recently asked people if they though the economy was recovering:

And remember this graph, when Pew Research recently asked people if they though the economy was recovering:

So, on the whole, consumers don't think the economy is "crummy," either. More like "meh," neither particularly good nor particularly bad.

But here is the most telling and interesting breakout of that confidence, from Bespoke Investment via Cam Hui, comparing confidence among those earning more than the median (red), and $30,000 - $50,000 (blue):

Note the big difference - in fact, the biggest divergence in the history of the series. The choice of colors is appropriate. The more affluent tend to be Republican, the less so, Democrat. Affluent Republican voters - who usually have higher turnout anyway - appear to be reasonably satisfied with the economy, and thus likely to support GOP incumbents. Democratic leaning members of the working class are still as pessimistic as they were 10 and 20 years ago - with no compelling reason to reward Democratic candidates, who haven't been touting any program to deal with the ongoing malaise.

Subscribe to:

Posts (Atom)