- by New Deal democrat

Last week my colleague

Jeff Miller from A Dash of Insight unveiled a long essay about business cycle forecasting in which he showcased the nearly 40 year track record of Bob Dieli's "Mr. Model." Dieli started developing this model in the 1970s and has kept track of it in real time since. While the timing has sometimes been off, it has flashed at least a yellow signal in advance of every recession in the last 50 years, and an all clear in advance of the end of the recession - and, needless to say, well in advance of the NBER officially dating the recessions.

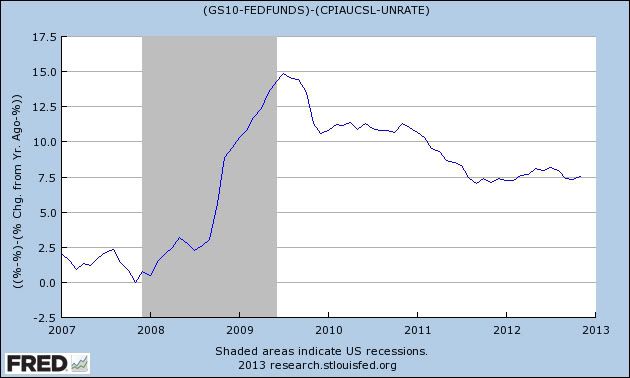

The model relies upon what Dieli calls the "aggregate spread." This spread measures the yield curve (defined as the spread between long term treasuries and the Fed funds rate) plus a linear version of the Phillips curve (specified as the unemployment rate minus the inflation rate). Whenever the yield curve, plus the unemployment rate, minus the inflation rate, is above 2% (or 200 basis points), the shows expansion. Below 2% (or 200 basis points) it warns of recession. If it falls below 0%, the recession is bound to occur. The model looks out about 9 weeks in advance.

While this metric has an excellent 40 year track record, unfortunately, I think the model stands a 50/50 chance of completely missing the next recession. Here's why.

The model works perfectly for the inflationary era in which it was designed. Typically, in inflationary expansions and recessions, the rate of inflation increases (a negative for the model). Trying to rein in that inflation, the Fed raises rates (hence the yield curve narrows or even inverts, another negative for the model). Usually the Fed increases rates above the rate of inflation. So long as unemployment remains relatively low and relatively constant, this will be sufficiently negative for the model that a yellow and usually red signal will be given.

When the recession hits, demand falters, and the inflation rate decreases (a positive) while the unemployment rate spikes (also a positive in this model). Seeing the weak data, the Fed begins to lower rates (making the yield curve more positive). The model gives an all-clear. Meanwhile, the subdued inflation and lower interest rates restore or increase corporate profits and spending. A new expansion begins.

But what about a debt-deflationary driven recession, such as described by Prof. Irving Fisher or Hyman Minsky as an explanation for the Great Depression? In that case, deflation isn't a positive, but a negative, and the deeper the deflation, the more pernicious the result. Further, to the extent these types of recessions tend to result in longer periods of recovery, the unemployment rate remains elevated - giving a false positive signal in the model.

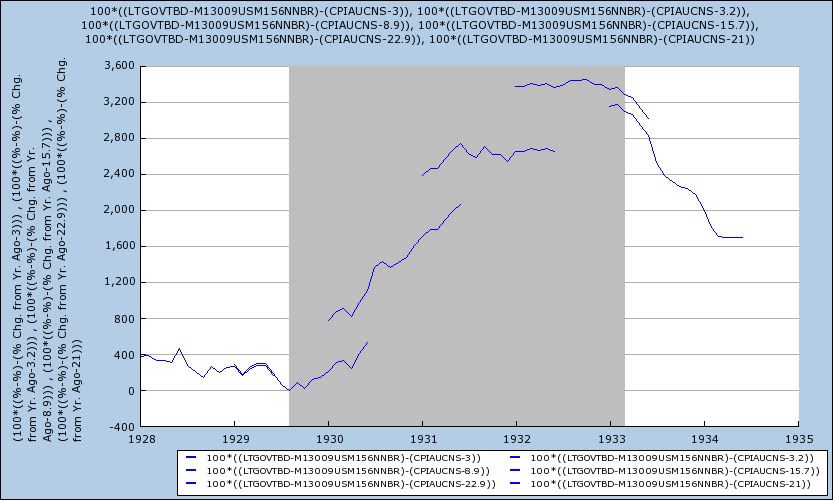

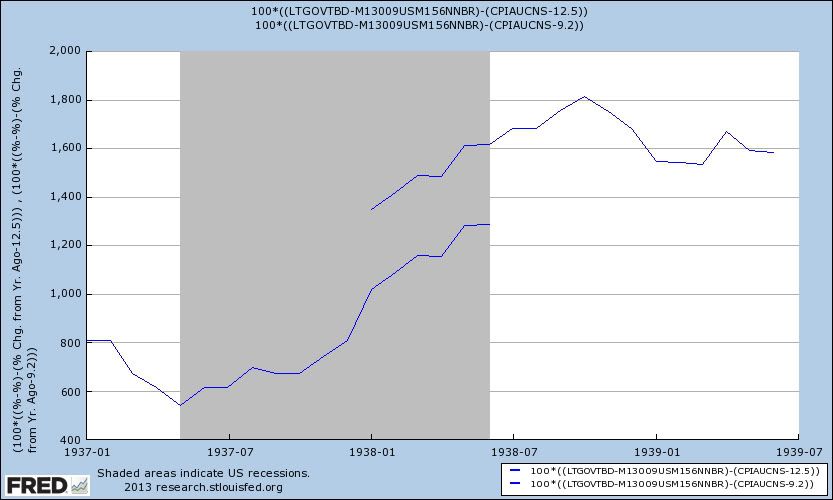

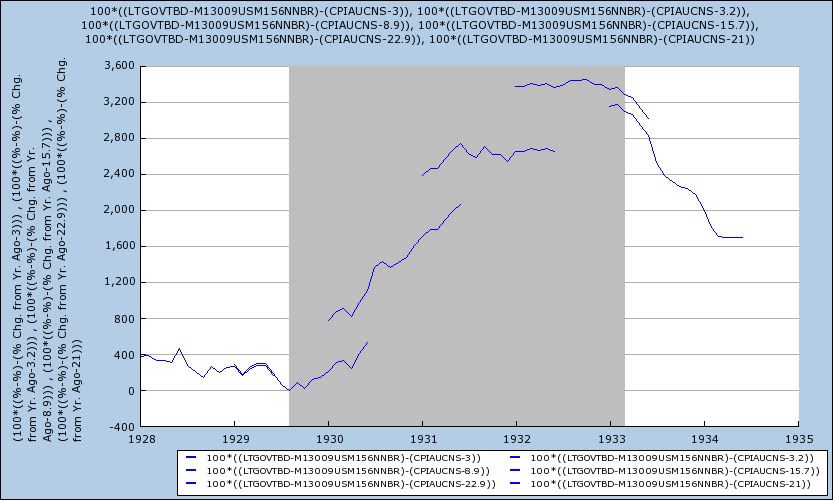

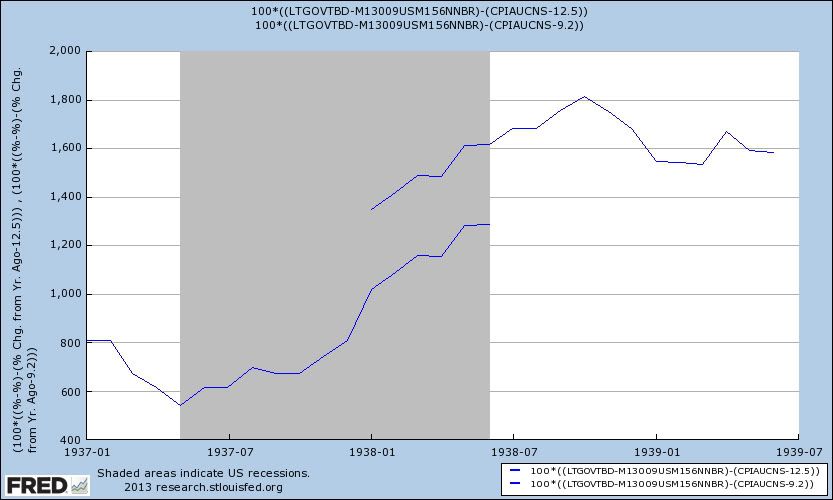

We don't have to speculate because I've done the math, and I can show you the results Dieli's model gives for the 1929-32 catastrophe, as well as the 1938 deep recession. In order to give me a yield curve measure, I had to substitute for 10 year treasuries the series LTGOVTBD (long term government bonds), and also the discount rate of the NY Fed instead in lieu of the Fed funds rate. Because the unemployment rate for this period is only available on an annual basis, the measure becomes somewhat disjointed. I've also carried the data including the unemployment rate 6 months into the next year, to give a better idea of what the range for any monthly unemployment rate would have been. But the results are unambiguous.

Here is the yield curve, plus the unemployment rate, minus the inflation rate, for 1928-33:

And here it is for 1937-38:

The model does predict the onset of recession in 1929, dipping into its warning signal territory, although it never goes below zero. But then, because it reads the double-digit unemployment rate as a huge positive, it forecasts robust economic expansion for 1931 and 1932! Just as badly, it never sees the 1938 recession coming at all, having never dipped below about 400 basis points.

Part of the problem is that the unemployment rate, as used in the model, really just tells us that inflationary recessions tend to be short, so when unemployment spikes, the bottom of the recession is probably less than a year away. But in so doing, it also tacitly assumes that a recession cannot start in the presence of an already high unemployment rate -- something definitively rebutted by the 1938 recession, which started in the presence of nearly 10% unemployment, even counting CCC and WPA workers among the employed. But even moreso, the simple fact is that deflationary recessions are different, and a model perfect for inflationary recessions -- most notably, any model relying too heavily on the yield curve -- fails with deflationary recessions. Deflationary recessions can and do take place in the presence of a positive yield curve. For example, the curve was positive from late 1929 into 1931, and all through the mid to late 1930s.

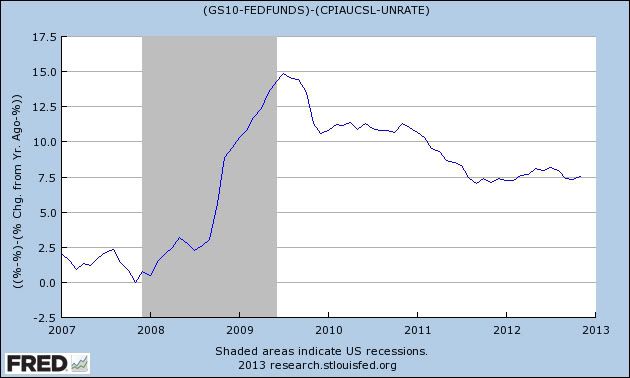

The "great recession" of 2008-09 was in part just such a deflationary event. YoY deflation bottomed out at -2%. Asset prices - particularly of housing, but of all sorts of fancy financial paper as well - collapsed. Unsurprisingly, after correctly giving a warning before the onset of the recession, it surged in mid 2008, as unemployment surged and inflation plummeted. It gave one of its weakest negative signals ever, for the deepest recession in 70 years:

With paltry wage and salary gains, and a government fetish for austerity, the next recession is likely to have deflationary components as well, although it may start with a brief inflationary spike.

Suppose the unemployment rate remains stable, but long term interest rates rise 1%. Yield curve models will see the spread widening and read it as a positive. But Joe Sixpack's refinancing of debt will come to a screeching halt, and if we were to get an oil price driven spike of inflation to 5%, he would never be able to keep up. It is extremely likely that a new recession would ensue. But yield curve driven models such as Dieli's will see a +2% yield curve, plus 7% or higher unemployment, minus 5% inflation, for a net of 4%, or 400 basis points. As with 1938, it would completely fail to see the recession coming.

Similar concerns about business cycle models that rely upon a particular structural elements of the economy have been shown by Dwaine Van Vuuren in

this RecessionAlert post, which I highly recommend to you. The bottom line is, before embracing any particular model at any given time, it is necessary to keep in mind the structural background in which it was developed.