Here are some puppy pictures. Why? Because I'm a sucker for puppies, that's why

I'll be back on Monday. Have a safe weekend.

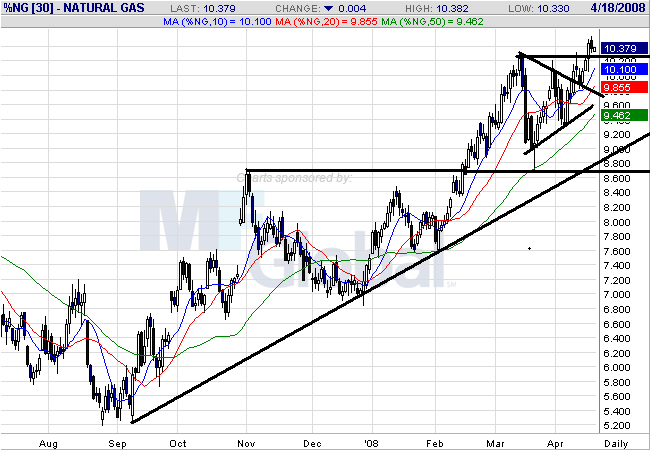

Americans feeling the pain of record gasoline prices now face the likelihood of another fuel shock, from natural gas.

Prices in the U.S. have risen 93% since late August as power-hungry nations like South Korea and Japan compete in a global natural-gas market that scarcely existed a half-decade ago. Still, U.S. prices are as low as half the level of some overseas markets, suggesting they have much further to rise.

The global appetite for natural gas has profound implications for a U.S. economy already tipping toward recession and struggling against inflation pressures. The fuel heats half of U.S. homes, generates 20% of the country's electricity and is used to make everything from fertilizer to plastic bags. In March, rising natural-gas prices contributed to a higher than expected 1.1% increase in producer prices, according to the Labor Department.

U.S. natural-gas output has actually been rising in recent months, and not everyone agrees that prices are destined to surge. However, a significant number of financial players are now betting on an increase.

Thus far, roughly 20% of the companies in the S&P 500 have reported, and overall first-quarter earnings are down 22.1%, according to Brown Brothers Harriman. But excluding financials, earnings are up by 8.2%. If the actual reported earnings are combined with estimates for the remaining companies, earnings are coming in slightly above expectations, at a 12.9% decline. Excluding financials, they're up a healthy 9.5% Brown Brothers says.

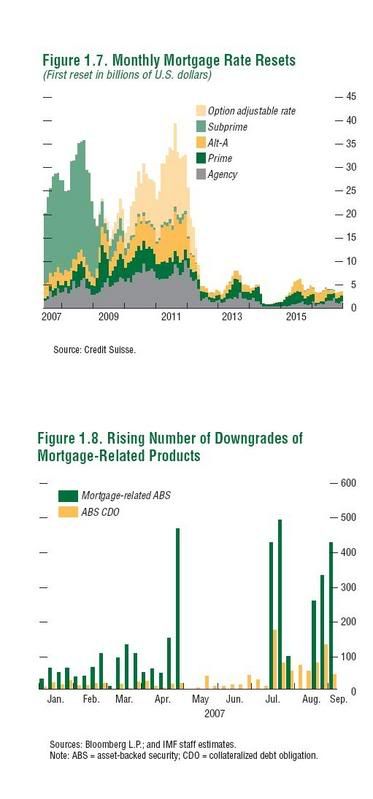

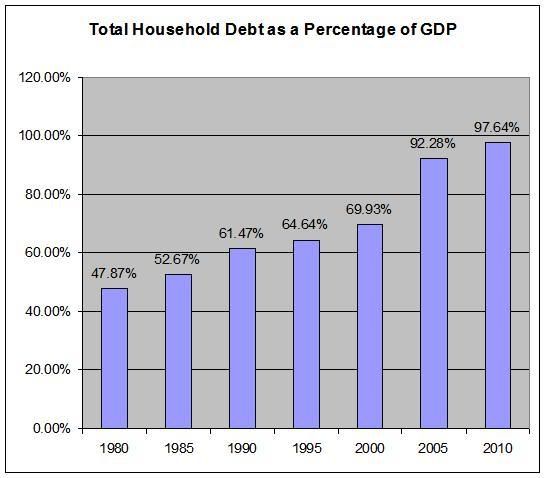

But large financial institutions have grown more cautious about lending to even highly rated companies since their capital reserves have been depleted by subprime-related bonds that have soured and loans to speculative-rated, or junk, companies that are stuck on their books. Such a curbing of lending is another worrying sign for the sagging U.S. economy since it means companies will have a more difficult time raising money during what is already a trying time.

Despite some variation across Districts, employment levels appeared to be little changed, on balance, from recent months. Some weakening in the job market was reported in the New York, Atlanta, Chicago, St. Louis, and Minneapolis Districts. Cleveland reported flat employment levels, while Richmond indicated mixed trends. Boston and Kansas City indicated modest increases in employment, with some deceleration indicated in the latter. Firms in the Philadelphia, Atlanta, and Minneapolis Districts reported layoffs, reductions in work hours, or hiring freezes in response to current or expected slowing in economic activity.

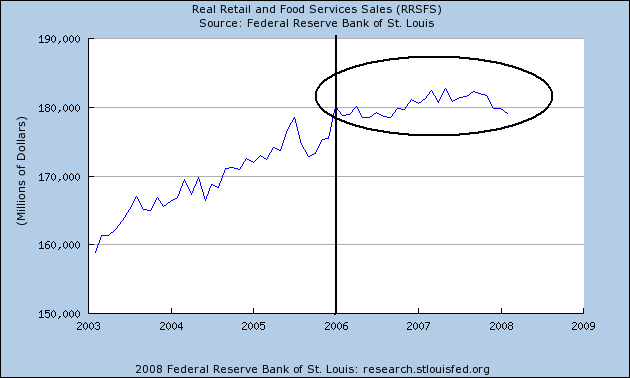

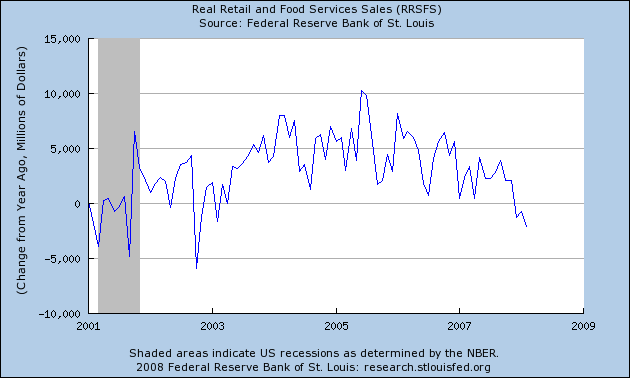

Consumer spending weakened in most, but not all, Districts since the last report. In particular, automobile sales were generally reported to be flat or declining. Vehicle sales were described as unchanged or falling in the Philadelphia, Cleveland, Atlanta, and Dallas Districts and were characterized as weak in the Richmond, Atlanta, Chicago, and San Francisco Districts. However, Kansas City reported that auto sales rebounded in March, though they remained lower than a year earlier. Non-auto retailers reported that sales were sluggish or declining in ten Districts. Elsewhere, Boston noted mixed sales trends, and New York reported a modest pickup since the last report. Chicago, San Francisco, and, to a lesser extent, Philadelphia noted relative strength in demand for luxury goods.

Manufacturing activity was varied, with some Districts reporting a slight increase in activity, some indicating weaker activity, and several noting that activity was mixed or had held steady. Chicago, Boston, and Richmond reported that activity was rising, but not substantially, while New York, Kansas City, Philadelphia and Dallas all reported that activity had weakened. St. Louis and Cleveland said that activity had held steady, while Atlanta, Minneapolis and San Francisco saw activity as mixed.

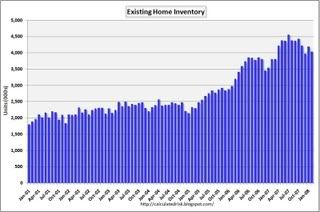

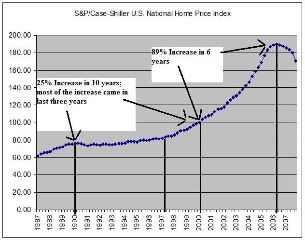

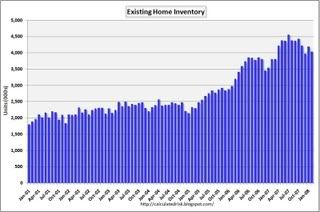

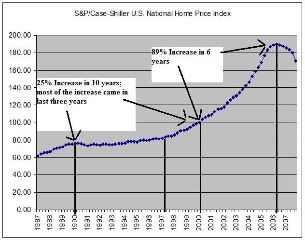

Housing markets and home construction remained sluggish throughout most of the nation, though there were few signs of any quickening in the pace of deterioration. Ongoing weakness in housing markets, in general, was reported in almost all Districts. Sales activity was generally reported to be declining in the Boston, New York, Philadelphia, Atlanta, St. Louis, Minneapolis, Dallas and San Francisco Districts, while Kansas City and Chicago noted slack demand and excess inventories. On the other hand, the Cleveland District saw some pickup in activity, while Richmond and Atlanta reported some pockets of improvement; Boston, Atlanta, and Chicago cited some recent pickup in traffic or buyer inquiries. New residential construction was reported to have remained at depressed levels, and none of the Districts reported any pickup since the last report.

Business contacts across all Districts continued to report increases in input costs and output prices. In particular, price increases were consistently reported for food products, fuel and energy products, and many raw materials. More specifically, increases in the price of chemicals, metals, plastics and other petroleum-based products were commonly cited. Most manufacturers have or are planning to increase prices in response to rising input costs, while the response of service firms has been more mixed, in part due to differences in competitive pressures. On balance, input costs have risen more rapidly than output prices, putting pressure on margins for many firms. Most Districts reported little change in retail price inflation, though Richmond and San Francisco noted some moderation. Most business contacts reported that wages were unchanged or were increasing moderately in all Districts. Business contacts in the Atlanta, Chicago, Cleveland, Dallas, Philadelphia, and San Francisco Districts indicated that there has been some upward wage pressure for skilled labor in some sectors that continue to experience shortages.

European inflation accelerated more than initially estimated in March, reinforcing the European Central Bank's resistance to cutting interest rates even as economic growth cools.

The inflation rate rose to 3.6 percent last month, the highest in almost 16 years, the European Union's statistics office in Luxembourg said today. The March figure is up from 3.3 percent in February and exceeds an estimate of 3.5 percent published on March 31.

Food and energy prices stoked inflation in March, and the euro extended its gains after the report, rising to a record against the dollar. ECB Executive Board member Juergen Stark yesterday said interest rates may not be high enough to contain inflation, while Greek colleague Nicholas Garganas said price pressure ``is more intense than previously foreseen.''

``Concerns about upside risks to the inflation outlook are unlikely to ease quickly, leaving little, if any, scope for the ECB soften its interest-rate stance,'' said Martin van Vliet, an economist at ING Group in Amsterdam. ``This may help push the euro-dollar to $1.60 in the short term.''

....

Food-price inflation accelerated to 6.2 percent in March from 5.8 percent in February, the highest since Eurostat began the current series in 1997. Rice climbed to a record $22.67 per 100 pounds today on rising demand and as floods delayed planting in the U.S. Wheat, corn and soybeans also have risen to records.

Energy-price inflation accelerated to 11.2 percent from 10.4 percent, the highest since May 2006. Crude oil has risen 79 percent in the last 12 months and reached a record above $114 a barrel yesterday.

Rice climbed to a record for a second day as the Philippines, the world's biggest importer, sought 1 million metric tons and floods delayed planting in the U.S., increasing concern of a global shortage.

The Philippines will hold a tender tomorrow for 500,000 tons of rice, with another to follow on May 5. A March tender filled just 61 percent of requirements at prices double those six months earlier. Last year, the country imported 1.9 million tons of rice, equivalent to about 15 percent of annual needs. Food lines have formed as people wait for rice.

Rice in Chicago surged 2.3 percent today to $22.67 per 100 pounds on rising demand and export curbs from some producing nations, stoking global concern about inflation and the potential for social unrest. Rice, the staple food for half the world, has more than doubled in a year. Wheat has gained 93 percent in that time, while corn is up 61 percent.

``We've seen an unprecedented bull run in rice prices,'' Luke Chandler, senior commodities analyst at Rabobank Group, said in an interview today with Bloomberg Television. ``It's almost becoming like a supply shock because the countries that rely on the imports aren't able to access the available sources.''

U.S. rice, corn and crude futures soared to record highs Tuesday on supply concerns, in turn boosting gold on inflation worries.

On the New York Mercantile Exchange, the front-month crude settled up $2.03, or 1.82%, at $113.79 on a combination of supply issues, rising diesel demand in China and persistent dollar weakness. Crude futures later rose to a record high of $114.08 after settlement.

Rice and corn futures rocketed to all-time highs on tight world grain supplies and planting delays, with the rally in crude providing an additional boost to grains.

Chicago Board of Trade rice prices have doubled since last September, with Asian prices soaring even more sharply since January as big importers have rushed to build stocks on fears that supplies will become scarce as exporters clamp down on shipments.

>

>The Producer Price Index for Finished Goods increased 1.1 percent in March, seasonally adjusted, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. This advance followed a 0.3-percent rise in February and a 1.0-percent increase in January. At the earlier stages of processing, prices received by producers of intermediate goods rose 2.3 percent after increasing 0.8 percent a month earlier, and the crude goods index advanced 8.0 percent following a 3.7-percent rise in February.

Among finished goods, the increase in the index for energy goods accelerated to 2.9 percent in March from 0.8 percent in the preceding month. Prices for finished consumer foods turned up 1.2 percent after declining 0.5 percent in February. By contrast, partially offsetting the acceleration in finished goods prices, the rise in the index for finished goods less foods and energy slowed to 0.2 percent from 0.5 percent in February.

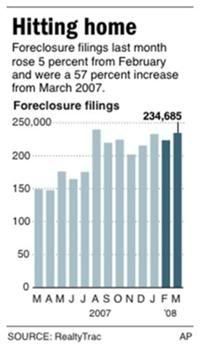

The number of U.S. homes receiving at least one foreclosure filing jumped 57 percent in March to 234,685, compared with 149,150 properties a year earlier. Filings include default notices, auction sale notices and bank repossessions.

The overall foreclosure rate is 5 percent higher than in February, which saw an unexpected month-to-month decline over January. March marked the 27th consecutive month of year-over-year increases in national foreclosure filings.

That meant one in every 538 households received a filing during the month. Forty-four percent were households that slipped into default for the first time and more than a fifth were homes banks took back.

Lenders took possession of homes at a sharply higher rate, up 129 percent over last year, as more homeowners relinquished their homes, said Sharga. Banks repossessed 51,393 properties nationwide, many of them without a public foreclosure auction.

"In a lot of cases, banks worked something out with the owner in advance and took back the keys and deed. For a homeowner, it's not as embarrassing and it's a little less of a blemish on their credit record compared to a foreclosure," Sharga said.

He estimates between 750,000 and 1 million bank-owned properties will hit the market this year, or about a quarter of the homes up for sale. In some areas, these properties will continue to slow sales and depress prices further.